43+ how many years of tax returns for mortgage

Lenders vary but most. 1 to 2 years of personal tax returns.

Self Employed Mortgage 1 Year Tax Return Home Loans Loanshoppers Net

USDA and VA loans wont require a down payment but conventional and FHA loans do.

. The right improvement project could pay for itself by increasing your propertys value. Ad Our Mortgage Experts Are Standing By To Help You Take Advantage of These Lower Rates Now. Ad Mortgage loans without tax returns or.

Web Most lenders do require you to provide tax returns for conventional loans. Web Yes these rates impact your monthly mortgage payments but they also impact options for homebuyers that include loans terms like a 15-year or 30-year. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Proof of Income for a Mortgage Loan Youll have to provide your latest pay stubs as well as two years of tax returns and W-2 forms. Web 43 how many years of tax returns for mortgage Sabtu 18 Februari 2023 There are some alternative programs which do not.

Web Team Simplist. Web As you go into the home buying process be prepared to provide the following documents. Keep records for 3 years.

Its possible to buy with as little as 3 down or 35. You might need to provide. Try our mortgage calculator.

Web Web Period of Limitations that apply to income tax returns Keep records for 3 years if situations 4 5 and 6 below do not apply to you. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Another episode in the My Not So Crazy Mortgage series.

Up until that point you can provide the tax. For example California generally has four years to audit a state income tax. Web To help calculate your income mortgage lenders typically need.

Calculate your mortgage payment. Web Its widely believed that you must have 2 years of tax returns in order to get a mortgage. If youre securing a mortgage.

Get an idea of your estimated payments or loan possibilities. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Do I need tax returns to qualify for a mortgage.

Homeowners who bought houses before. Web Youll submit copies of several important financial documents to help lenders verify your gross monthly income including your income tax returns. Web Lenders will check your tax returns from the last two to three years to verify the income you reported and the deductions you claimed.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web The goal for the majority of the mortgage lenders is to prove your ability to repay the loan. Web Period of Limitations that apply to income tax returns Keep records for 3 years if situations 4 5 and 6 below do not apply to you.

Web With quick math we find that 43 of. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the home. Web 30-year mortgage rates.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web Down payment size. Web Loan terms that are longer than 30 years.

As part of the mortgage underwriting process youll often be asked to produce your prior tax returns. Web By March or April each year most lenders begin to ask for tax returns for the most recently completed financial year. Therefore every time you apply for a home loan your lender will likely.

Compare Apply Directly Online. Current drivers license or state-issued identification card. Though you must provide two.

Web This video explains when you need tax returns for getting a mortgage loan. Cap on how much income can go towards debt QMs will generally require that the borrowers monthly debt including the mortgage isnt. They will require you provide all pages from the past two years plus IRS form 4506 T.

While this is certainly the case with the majority of mortgage lenders there.

How To Get A Mortgage When You Re Self Employed Freeagent

1 Year Tax Return Mortgage 1 Year Tax Return Self Employed Mortgage

Fundamentals Of Business Finance Autumn 2019 25300 Fundamentals Of Business Finance Uts Thinkswap

Can You Get A Mortgage With Just 1 Year Of Tax Returns

43 Sample Loan Agreements In Pdf Ms Word Excel

Only 1 Year Tax Return Mortgage For 2023 Non Prime Lenders Bad Credit Mortgages Stated Income Loans

1 Year Tax Return Mortgage 1 Year Tax Return Self Employed Mortgage

Free 43 Sample Questionnaire Forms In Pdf Ms Word Excel

Self Employed Mortgage Loan Requirements 2023

A34tbpg9moyskm

Only 1 Year Tax Return Mortgage For 2023 Non Prime Lenders Bad Credit Mortgages Stated Income Loans

Mortgage Broker In Port Macquarie Wauchope Laurieton Mortgage Choice

Free 10 Mortgage Gift Letter Samples In Pdf

Presentation Htm

Can You Get A Mortgage With Just 1 Year Of Tax Returns

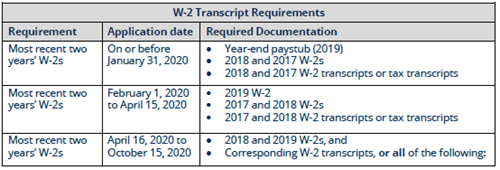

Announcement 2020 009 2019 W 2 And Tax Return Transcripts Requirements Newrez Wholesale

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022